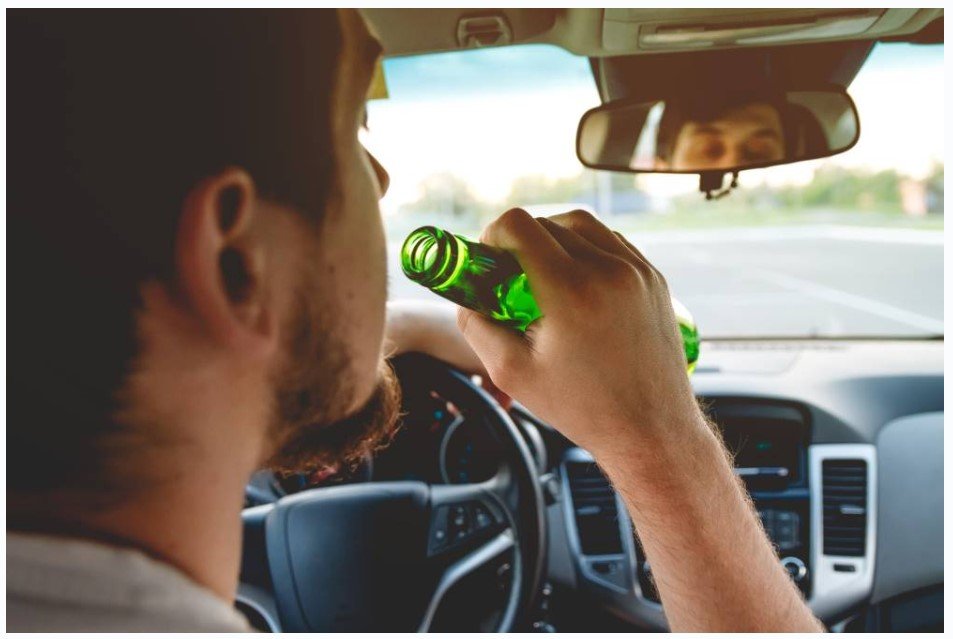

How does impaired driving affect the price of your insurance?

Driving while impaired is illegal. At the same time, some careless or reckless drivers still choose to drive while exceeding the legal limit of 80 mg of alcohol per 100 ml of blood. Besides criminal charges, how can drunk driving affect the price of your insurance?

What you need to tell your insurance company when you drive impaired

When you are arrested for impaired driving, it is important to protect your rights with the help of a criminal lawyer. Furthermore, you must also contact your insurer to inform them of your driver’s licence suspension or revocation. In this regard, you are required to disclose this information when your driver’s licence is suspended due to an arrest for impaired driving. You must also disclose this information to your insurer if you are convicted of drinking and driving and your licence is revoked. Finally, when you shop for car insurance with a company other than the one that provides your current coverage, you must also inform them of any suspension or revocation.

Do you have to be honest with your insurer?

Think it’s possible to hide a suspension or revocation of a driver’s licence from your auto insurer? Think again. These companies can easily check your driving record with the Société de l’assurance automobile du Québec (SAAQ). In fact, your insurer may even refuse to compensate you if you made a false statement or failed to mention this significant event.

Your insurance premium when arrested for impaired driving

So, when you are arrested for impaired driving, you have to notify your insurer. What happens next?

If you are found not guilty, there should be no impact on your car insurance premium. However, if you are convicted of impaired driving, that’s when things go south, because your insurer considers you to be an increased risk to yourself and others.

Each insurer has its own rates and premium increases are made accordingly. When reviewing your premium after an impaired driving conviction, your insurer will consider several factors including your age, the history of your case and whether there are any aggravating factors in your particular situation.

When you are permitted to drive again after your suspension, which can easily range from 12 to 60 months in the case of a repeat offence, your automobile insurance premium could easily double for at least three years. Likewise, you will probably find it very difficult to reinsure yourself without going through a specialized insurer.

Impaired driving, insurance and defending your rights

When you are arrested and convicted of impaired driving, your insurance premium isn’t the only thing that increases. In addition, you will be responsible for any costs related to your criminal record, towing fees and contribution to the Criminal Injuries Compensation Plan (IVAC), if applicable.

The best way to avoid this kind of problem is prevention and moderation. If you know you’re going to drink, don’t drive.

For more information or if you need the advice of a criminal lawyer after an arrest for impaired driving, contact our law firm.